where is my philadelphia wage tax refund

How do I request a new one. If you have questions email refundunitphilagov or call at 215 686-6574.

Why Was My Refund Request Denied Answers To Frequent Wage Tax Questions Department Of Revenue City Of Philadelphia

24 hours after e-filing 4 weeks after you mailed your return Updates are made daily usually overnight.

. Wheres My Income Tax Refund. I never received a check. Refund requests can be submitted to the Philadelphia Department of Revenue after the end of a tax year or in 2021 for days worked outside the city during the current crisis.

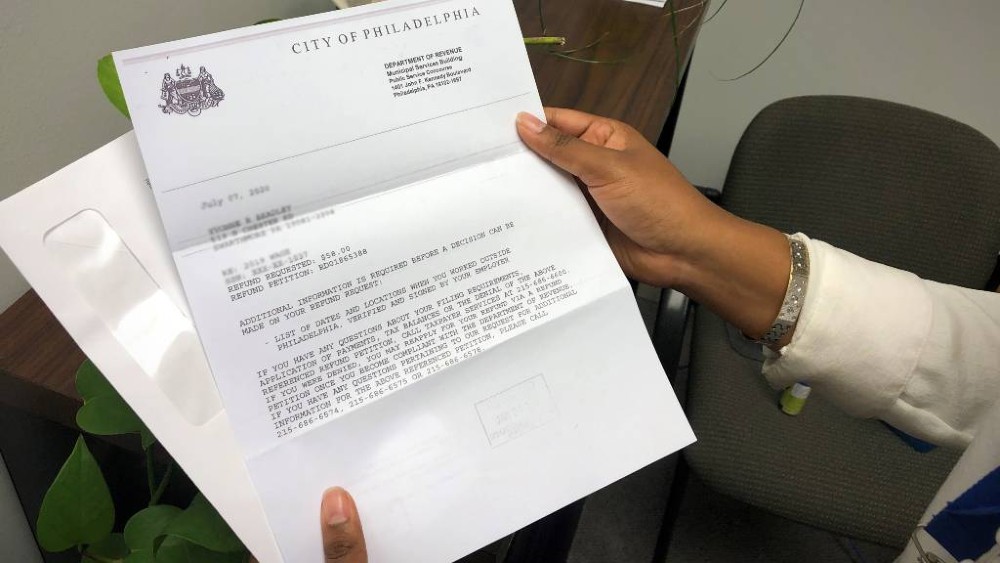

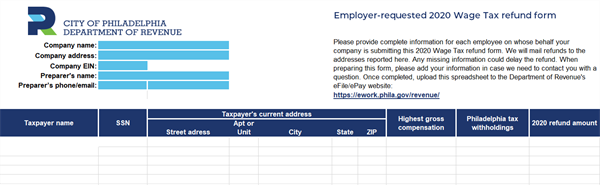

Philadelphia says A petition for refund of erroneously withheld wage tax from an employee must be made by the employer for and on behalf of the employee. The Philadelphia Department of Revenue has provided more information about its Wage Tax policy for non-resident employees during the COVID-19 pandemic. MyPATH functionality will include services for filing and paying Personal Income Tax including remitting correspondence and documentation to the department electronically.

File a Non-Resident Covid Ez Refund Petition with the Philadelphia Department of Revenue. You can determine this from looking at your W-2 and applying a bit of algebra reviewing your paystubs or asking your payrollHR department. Find out during what period your employer withheld Philadelphia Wage Tax in 2020.

Free tax-prep help Temple Universitys Fox School of Business will again offer the free Volunteer Income Tax Assistance VITA program. Check My Refund Status Wheres My Refund. Almost nobody qualifies for a refund normally but this year due to covid if your office was closed and you dont live in the city you should get a refund for the hours worked out of the city.

Begin Main Content Area. We expect the normal 6-8 week processing time to be longer this year. Finally you have three years from when your return is due to get your city wage tax refund.

Online Account allows you to securely access more information about your individual account. Ask your employer if they are submitting the Wage Tax Refund Petition on your behalf. Normally Philadelphia non-residents employed in the city can get a wage tax.

For refund-related inquiries please call 215 686-6574 6575 or 6578. Refund applications require an employers signature verifying time worked outside of the city. How much money will this save me.

Pennsylvania Department of Revenue. Taxpayers Can Use myPATH for PA Personal Income Tax Filing Prior to. - Personal Income Tax e-Services Center.

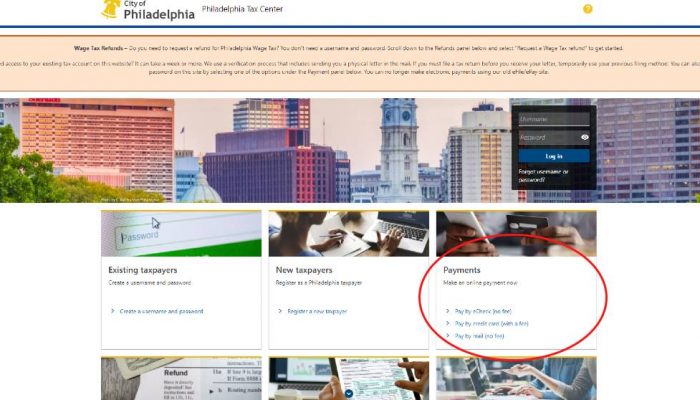

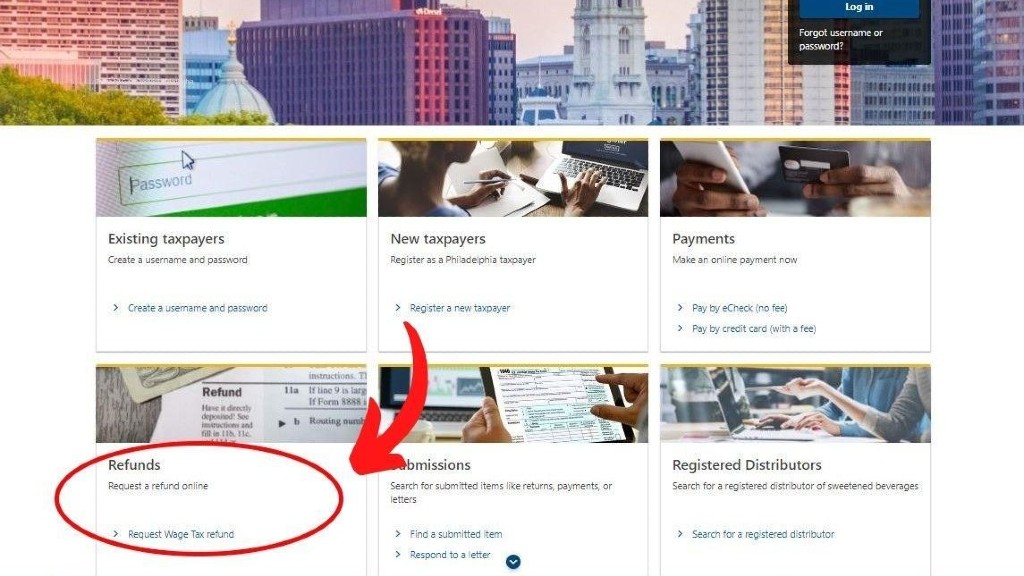

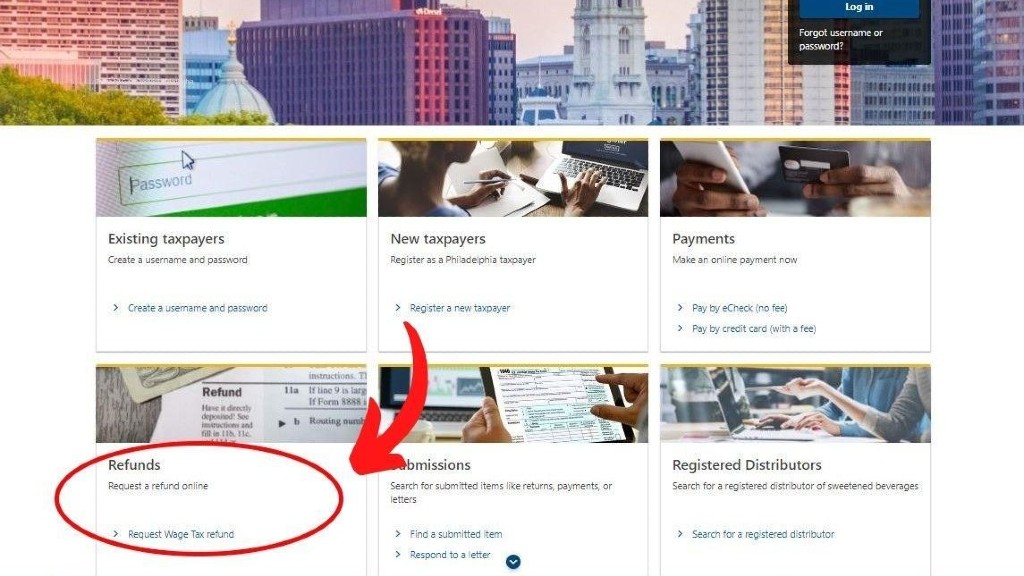

The employee wage tax refund claim form will be available the first week of February 2021 via the City of Philadelphias website. For more information on myPATH visit. Visit the Philadelphia Tax Center to complete an online Wage Tax refund form today.

You can email the Department of Revenue at refundunitphilagov or call at these phone numbers. This allows us to verify if a check was issued. They were late updating the form from 2019 this year.

Speak with a member of our Refund Unit about your request by calling. It is available every year. Will display the status of your refund usually on the most recent tax year refund we have on file for you.

Changes have been made to the tax filing process while filling out your 2021 taxes NBC10s Tracy Davidson and the NBC10 Responds Team help you through the process. PHILADELPHIA WPVI -- So many people are working from home during the pandemic and that could impact your taxes. All 2020 refund forms should be available on the citys website.

Philadelphia City Wage Tax Refunds Employees who are nonresidents of Philadelphia and who are required to work at various times outside of Philadelphia within a calendar year may file for a wage tax refund directly with the City of Philadelphia. The IRS has announced a. Eligible nonresident employees may file a refund claim for the wage tax withheld while they worked from home as required by the employer during 2020.

You will not receive a refund if you owe delinquent taxes or fees to the City of Philadelphia. Wage Tax refund requests for 2020 can be submitted with accompanying W-2 forms starting in 2021. The first step is to email refundunitphilagov.

The Department of Revenue e-Services has been retired and replaced by myPATH. If you have trouble requesting a Wage Tax refund on the Philadelphia Tax Center please call 215 686-6600. Remember you will not receive a refund unless your employee signs the form.

You can also email refundunitphilagov for help or answers to your questions. Property TaxRent Rebate Status. 215 686-6574 215 686-6575 215 686-6578 Often we can answer your questions or resolve your issues over the phone.

Claimants must include a copy of their W-2 along with a signed letter on employer.

![]()

Philadelphia Wage Tax Refunds Reboot For 2021

Request 2021 Wage Tax Refunds Online Department Of Revenue City Of Philadelphia

How To Get Your Philly Wage Tax Refund Morning Newsletter

Philadelphians Who Work Outside Pa Could Be Eligible For Wage Tax Break Whyy

How To File For The Philadelphia Wage Tax Refund Nbc10 Philadelphia

City Officials Say Philadelphia Wage Tax Refunds Are Delayed 6abc Philadelphia

Covid Makes Everything Difficult But Philly Makes Tax Refunds Easier

How To Get Your Philly Wage Tax Refund Morning Newsletter

5 Things To Know About Wage Tax Department Of Revenue City Of Philadelphia

Success Wage Tax Refund R Philadelphia

There S A New Tax Refund Available In Philadelphia This Year Philadelphia Legal Assistance

Covid 19 Tax Implications For Philadelphia Residents And Workers

/cloudfront-us-east-1.images.arcpublishing.com/pmn/33EDTZPRGBDMLFDDOJ32TVJ7K4.jpg)

How To Get Your Philly Wage Tax Refund Morning Newsletter

City Council Approves Bill To Help Philadelphians Collect More Than 600 Million In Tax Refunds Philadelphia City Council

Delayed City Wage Tax Refunds Still Being Paid Nbc10 Philadelphia

Philadelphia Wage Tax Refund Program Goes Online To Ease Process

Over 42 000 Philadelphians Use New Online Tax System On Top Of Philly News

Who Is Entitled To A Wage Tax Refund Department Of Revenue City Of Philadelphia