indiana state tax warrants

The Indiana State Tax Warrants are downloaded to the Clerks Office computer system from the state level. If your account reaches the warrant stage you must pay the total amount due or accept the expense.

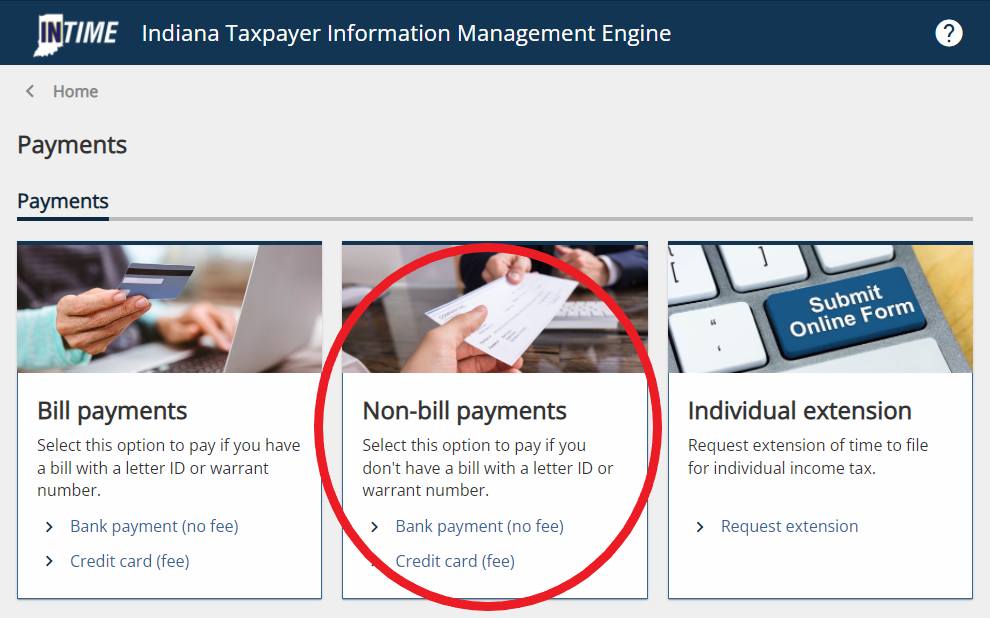

Dor How To Make A Payment For Individual State Taxes

Doxpop provides access to over current and historical tax warrants in Indiana counties.

. The Sheriff of the county is tasked with assisting in the collection of monies owed to the Indiana Department of Revenue through a process of Tax Warrants. If you have questions about your Indiana tax warrant you can call the Indiana DOR at 317-232-2240. A tax warrant is a notification to the county clerks office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Timely filing and elimination of snail mailmeans time and money saved by Clerks and DOR. Indiana County Sheriffs are required by State Statute to collect delinquent State Tax.

Indiana State Tax Warrant Information. Warrants for Collection of Tax. Taxpayers must complete the Expungement Request Form and submit any documentation that may support the request.

Tax Warrant for Collection of Tax. Indiana State Prior Year Tax Forms - Click to Expand. Public access to e-tax warrantsmade available throug See more.

Warrants issued by local county state and federal law enforcement. Pursuant to this law. What is a tax warrant.

Find Indiana tax forms. Our service is available 24 hours a day 7 days a week from any location. Lieberman Technologies is proud to provide Indiana Sheriff offices with Automated Tax Warrant System ATWS.

The Clerks office has a public terminal that you can use to access these records. Per Indiana Code 35-33-5-1 a search warrant can be requested and issued to search a place for any of the following. If we do not receive a response to the.

Know when I will receive my tax refund. If a collection agency handles your tax warrant. How taxpayers may prevent a lien against their property.

About Doxpop Tax Warrants. Eliminates manual data entry saving significant time for Clerks. A Tax Warrant is not an arrest.

Office of Trial Court Technology. Satisfactions are processed immediatelyupon receipt making records more accurate and up to date. Property that is illegal to possess.

A Indiana Warrant Search provides detailed information on outstanding warrants for an individuals arrest in IN. Grounds for indictment the importance of probable cause and the conditions for the issue of an arrest warrant are defined by section 35-33-2-1 of the Indiana Penal Code. The earliest date a tax warrant may be filed and recorded.

Tax warrants create liens against property to collect unpaid taxes income or otherwise and are. Request a No-Obligation Consultation. State the department will mail a release of judgment to the taxpayer and the c ircuit clerk of.

User Agreement for e-Tax Warrant Search Services Contact Information For more information contact LaJuan Epperson at lajuaneppersoncourtsingov 317-234-2870 or toll free 888. These taxes may be for individual income sales tax withholding. A tax warrant is a notification to the county clerks office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional collection agency.

To let us know that you would like to subscribe to e-Tax Warrant Search Services mail the completed User Agreement to. ATWS is a software package that. Questions regarding your account may be forwarded to DOR at 317.

Dor Unemployment Compensation State Taxes

Statute Of Limitations On Tax Liens In The State Of Indiana Sapling

/cloudfront-us-east-1.images.arcpublishing.com/gray/BUPZWJA4RZJIZLDGJZTK6MLYMA.jpg)

Berrien County Treasurer S Office Warns Residents Of Scam Letter

Law Enforcement Warns About Tax Scam Hot 96 Today S Hit Music Evansville In

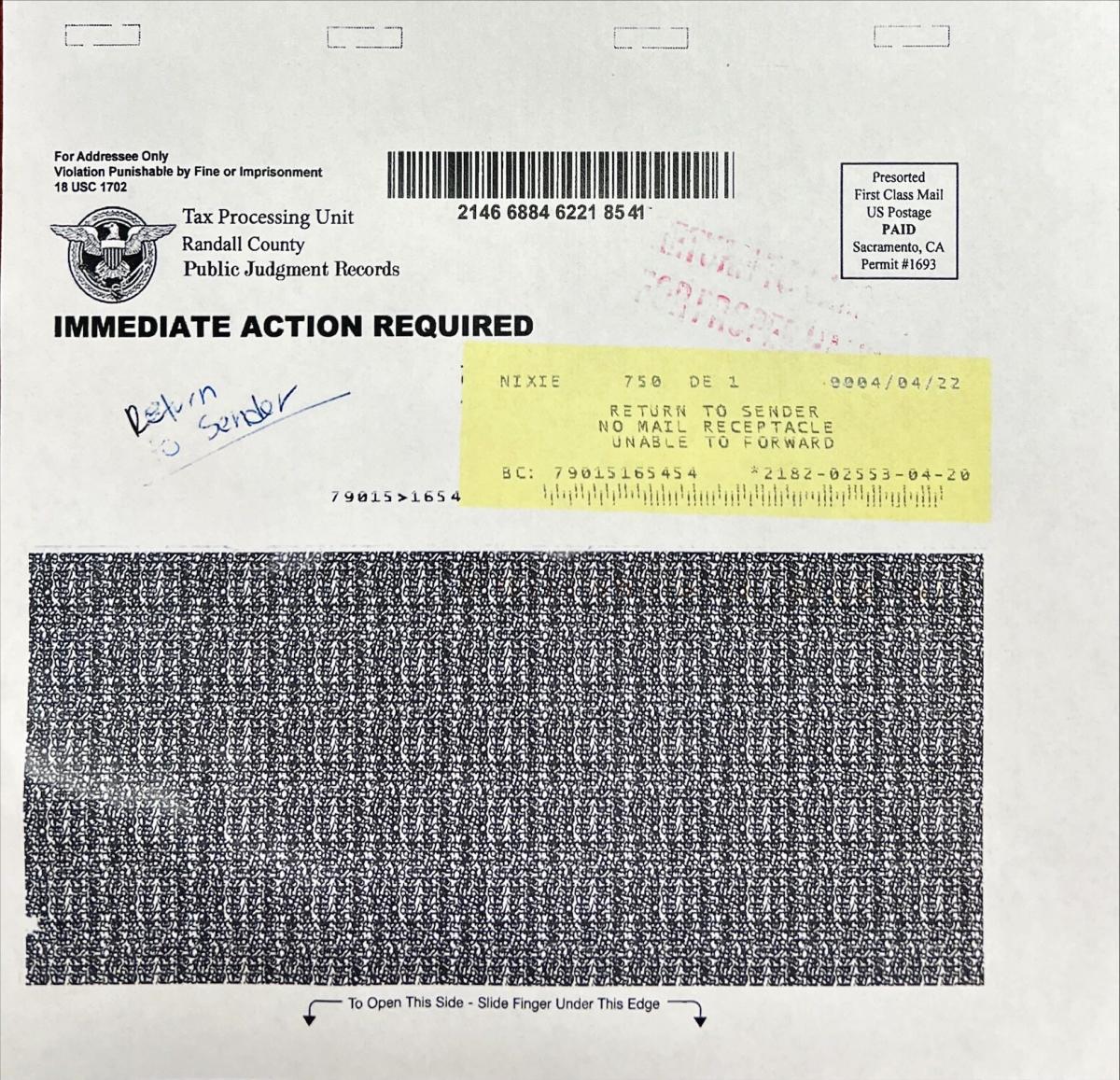

Fraudulent Tax Debt Letters Claiming Distraint Warrant Are A Scam Randall County Says

Can Indiana Issue A Warrant For Unpaid Taxes Levy Associates

Clerk S Responsibilities Clay County Indiana

An Overview Of Indiana Tax Problem Resolution Options

Owing Money To The Indiana Department Of Revenue Dutton Legal Group Llc

/cloudfront-us-east-1.images.arcpublishing.com/gray/BUPZWJA4RZJIZLDGJZTK6MLYMA.jpg)

Berrien County Treasurer S Office Warns Residents Of Scam Letter

The Indianapolis Star From Indianapolis Indiana On December 20 1985 Page 20

Indiana Warranty Deed Requirements Fill Online Printable Fillable Blank Pdffiller

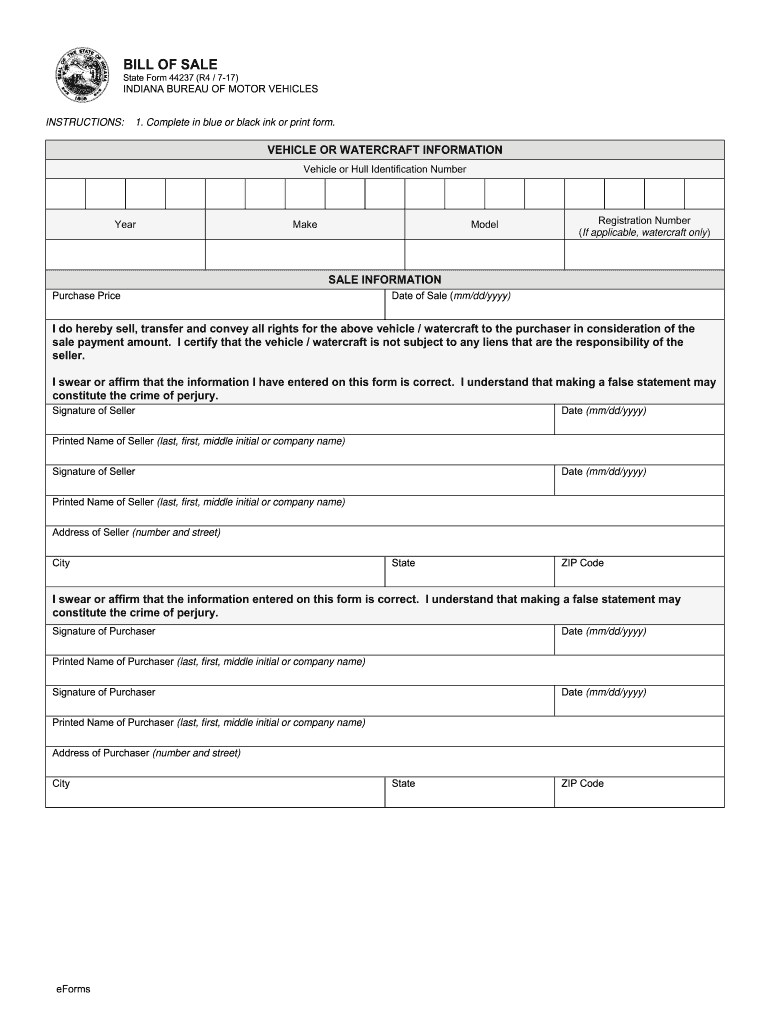

State Form 44237 R3 8 12 Indiana Fill Out Sign Online Dochub

Indiana S New Permitless Carry Law July 1 2022 Elkhart County Sheriff S Office

Doxpop Tax Warrant Partner Counties

Guide To Resolving Indiana Back Taxes Other Tax Problems

Up To 700 For Il Residents How To Get Your Tax Rebate Check

Unprecedented State Revenue Growth Triggers Tax Refund For Hoosiers